Jar, a fintech app aiming to simplify savings, faced a challenge: users didn't understand how their money was being saved or the associated charges, leading to confusion and churn. This case study explores how a focus on visual design transformed Jar's onboarding, fostering "Asset Understanding," increasing user confidence, and ultimately improving retention.

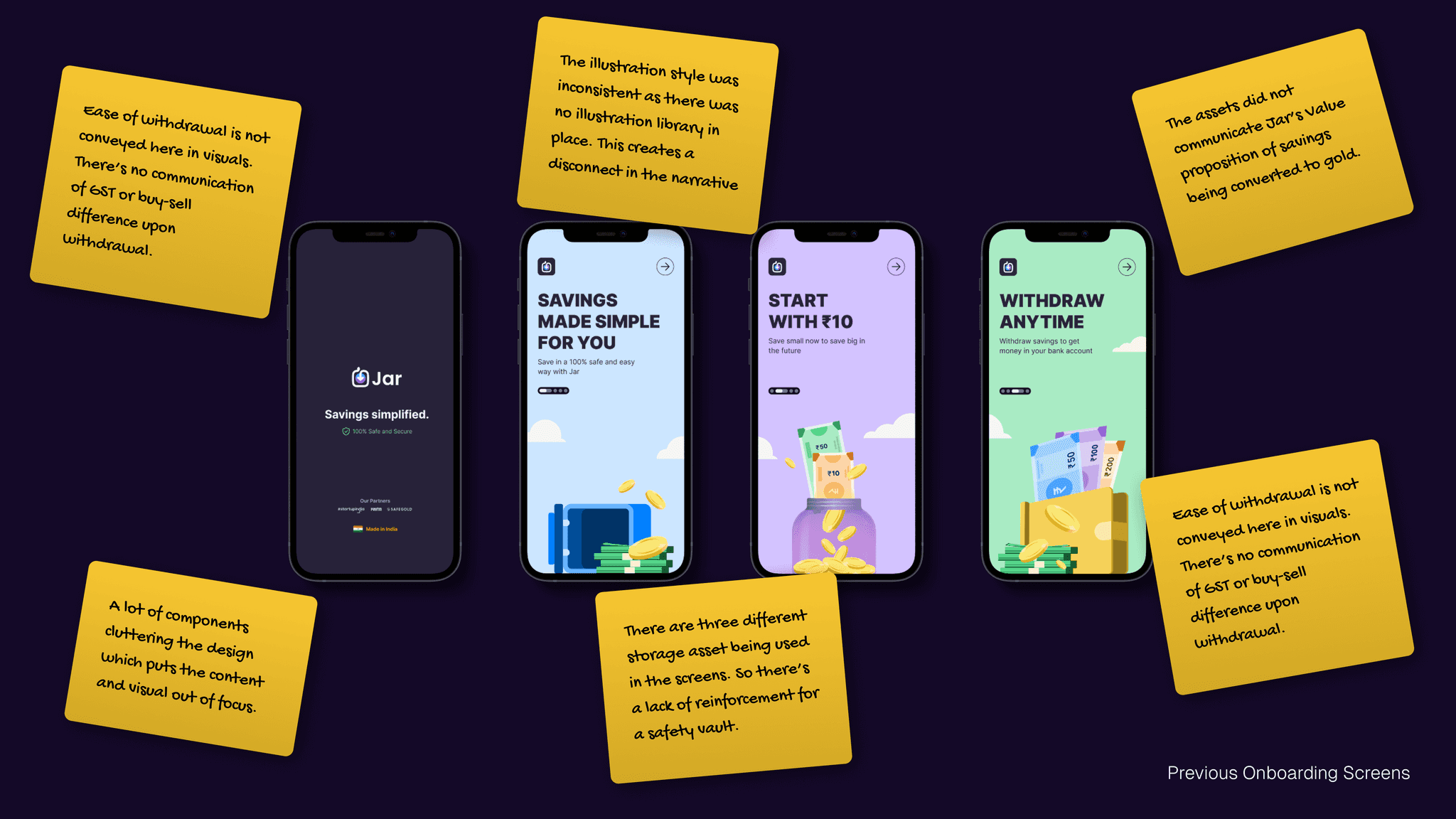

Jar's loss-making status stemmed from a fundamental disconnect between the app's value proposition and user perception. The problem was encapsulated in the user statement, "Jar is a loss-making app, when I put X, I get Rs. X-Y." This stemmed from two core issues:

Lack of Clarity on Savings Mechanism - Users were unsure whether their money was saved as cash, gold, or another asset.

Fee Structure - The app failed to transparently communicate charges like GST and buy-sell differences.

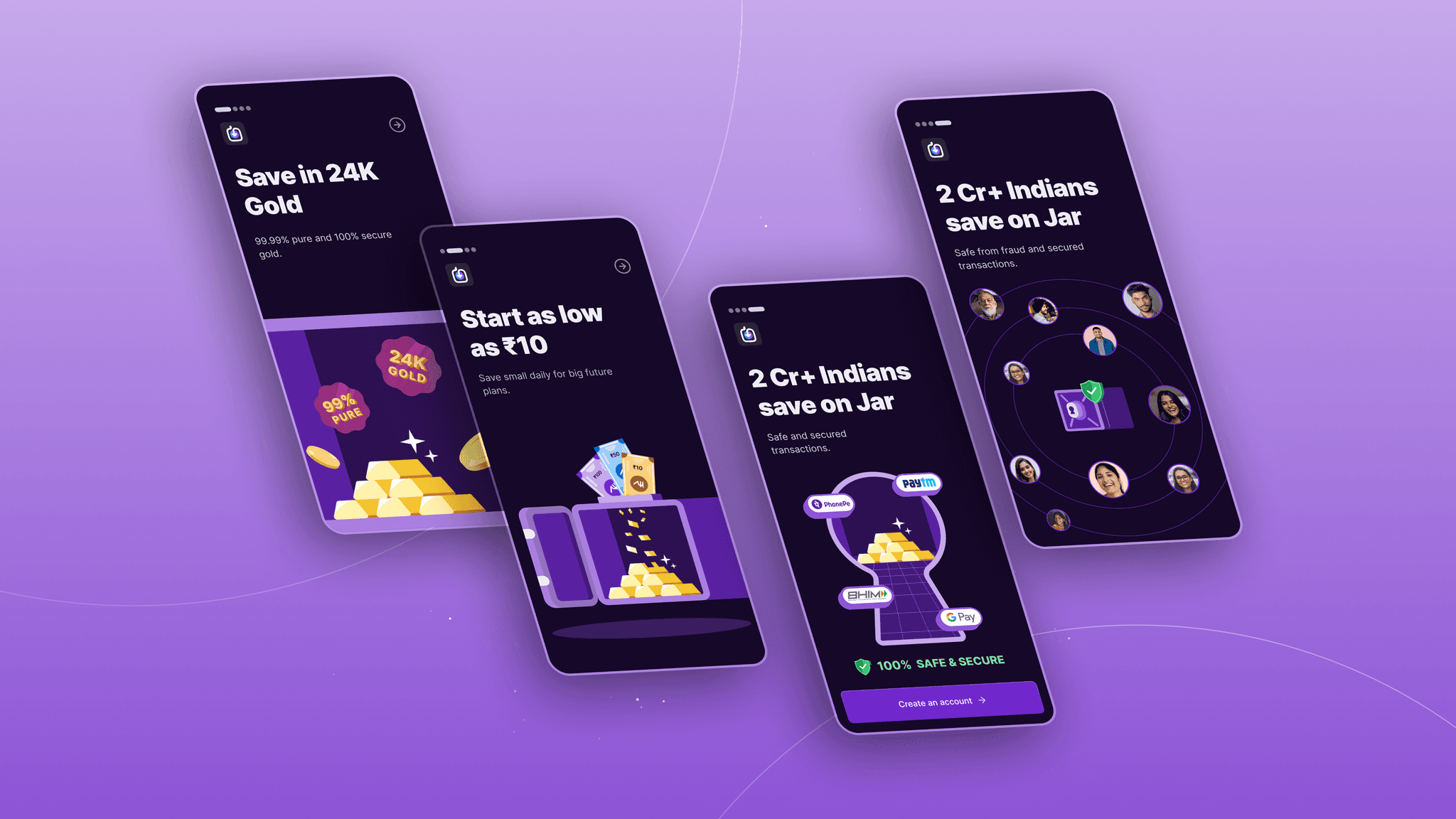

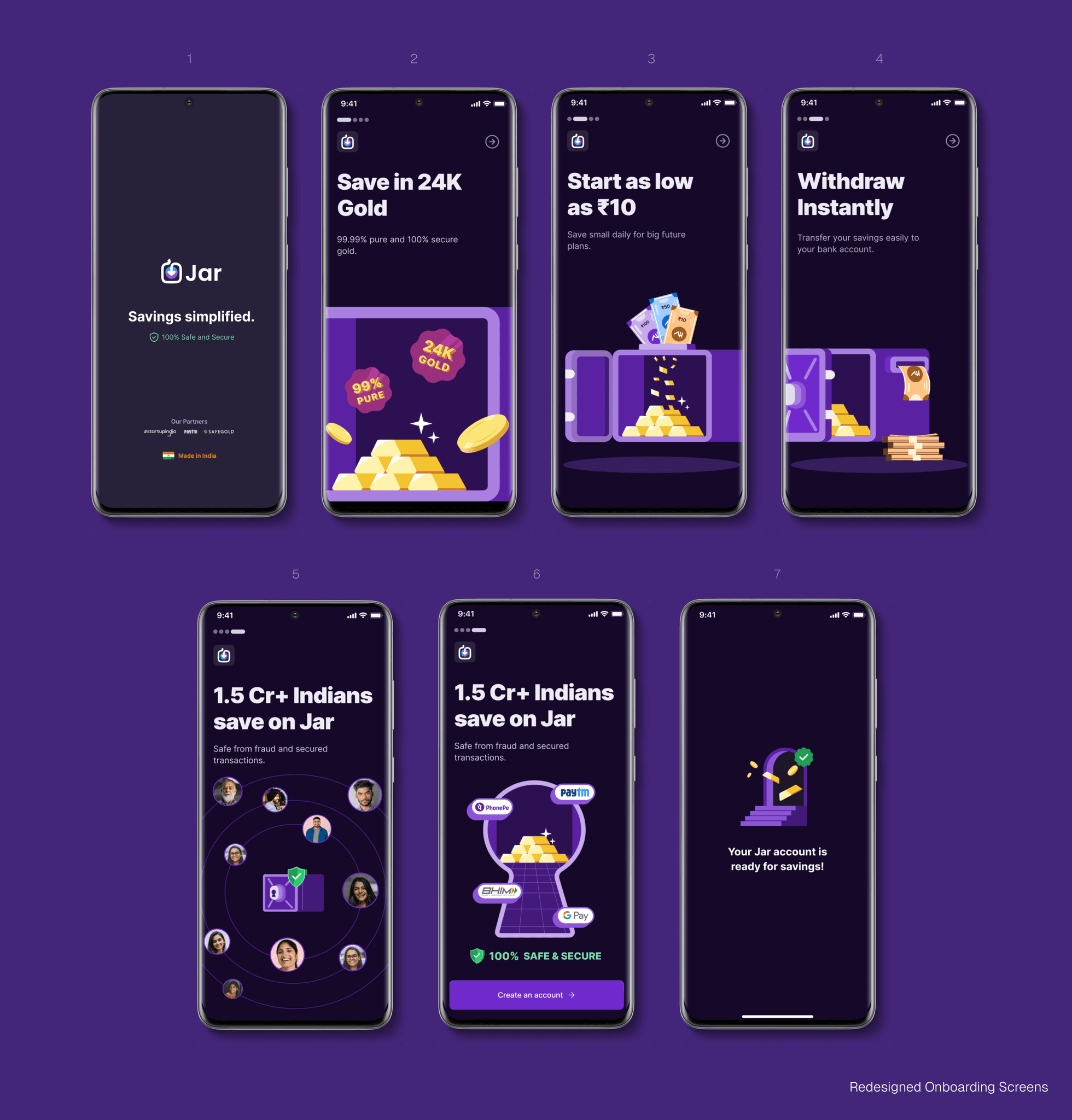

As a visual designer, my goal was to transform Jar's onboarding into an intuitive and engaging experience. We started by tackling the core issues of asset visualization and content design. Instead of relying on static visuals and numbers, we introduced content design and animations that clearly illustrated how a user's savings transformed into a tangible asset like gold. To combat information overload, we adopted a progressive disclosure approach. Key information was revealed step-by-step, ensuring users were never overwhelmed.

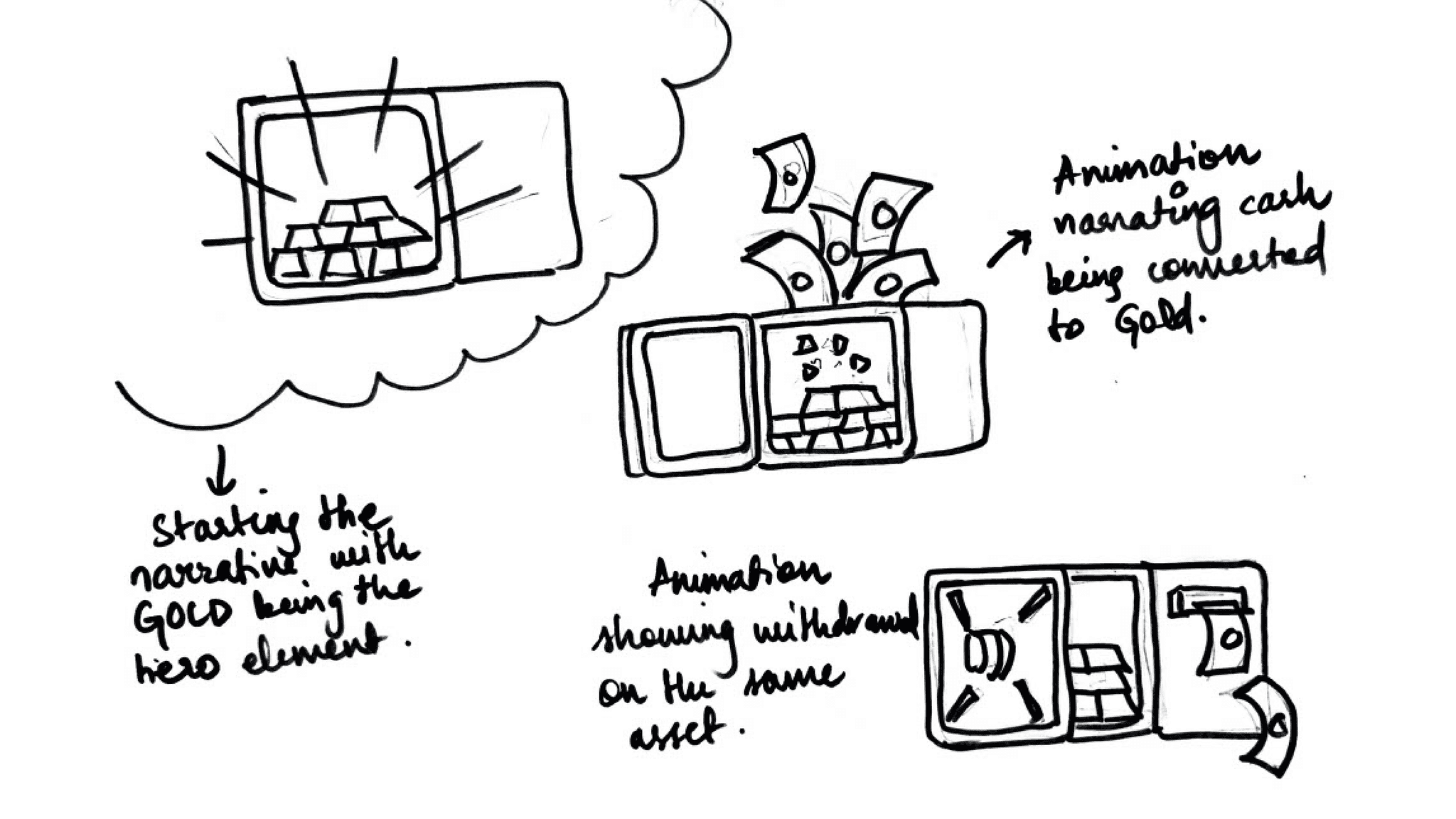

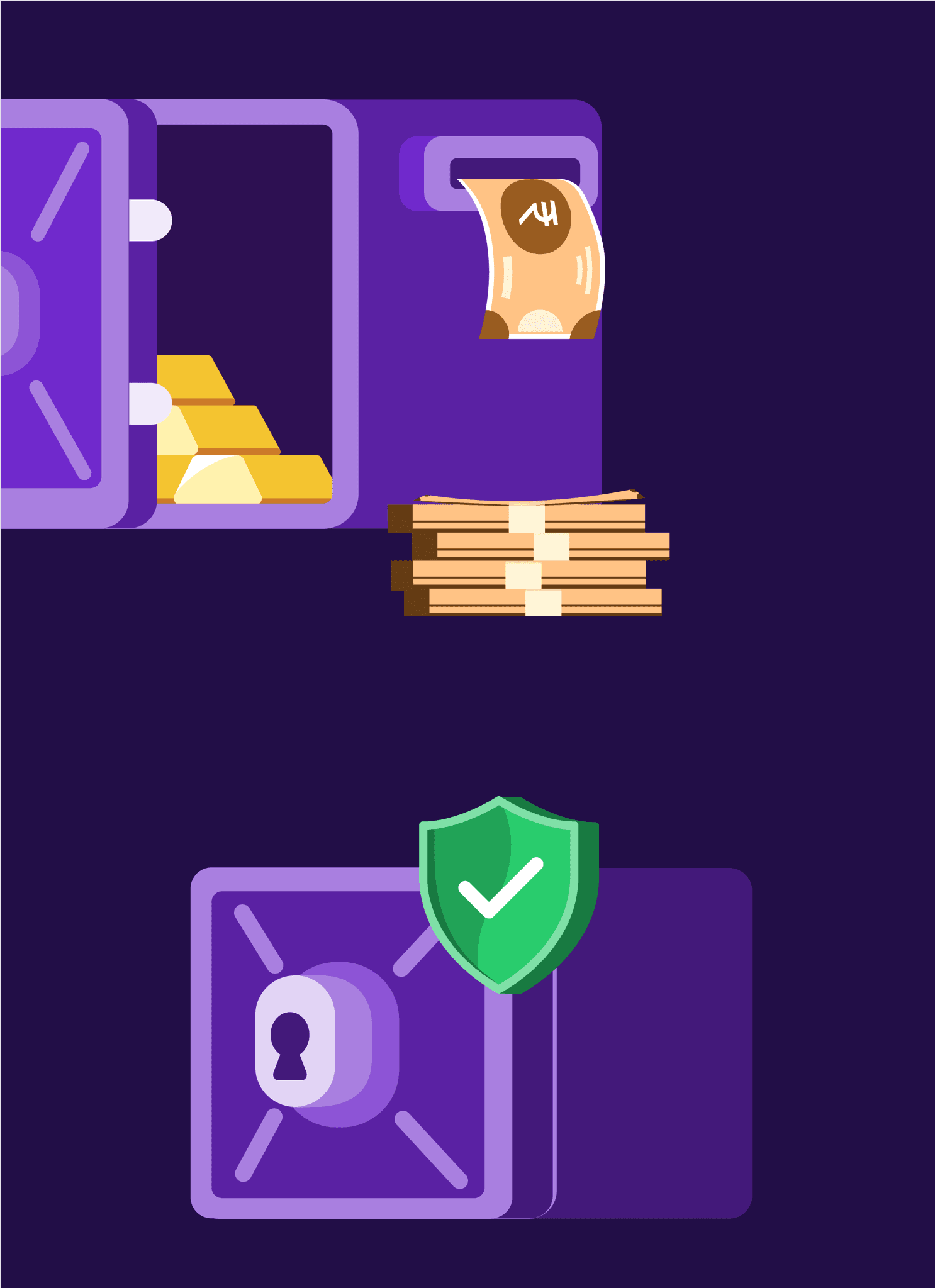

In our redesign, we prioritized visual storytelling to build an understanding of gold as an essential physical financial asset and trust. We established the vault as the central visual element, representing secure storage, with gold as the hero component on every screen. This shifted the narrative from generic "savings made simple" to the tangible benefit of "secured savings in gold."

Animations showcasing cash converting into gold within the vault reinforced this concept, while visuals demonstrating easy withdrawal options - either as physical gold or cash - addressed concerns. This streamlined approach not only clarified Jar's value proposition but also created a more engaging and cohesive onboarding experience.